tax rate 2018 malaysia

The archaic term suit in law is found in only a small number of laws still in effect todayThe term lawsuit is used in reference to a civil action brought by a plaintiff a party who claims to have incurred loss as a result of a defendants actions requests a legal remedy or equitable remedy from a. Personal Income Tax Rate in Denmark averaged 5981 percent from 1995 until 2022 reaching an all time high of 6590 percent in 1997 and a record low of 5540 percent in 2010.

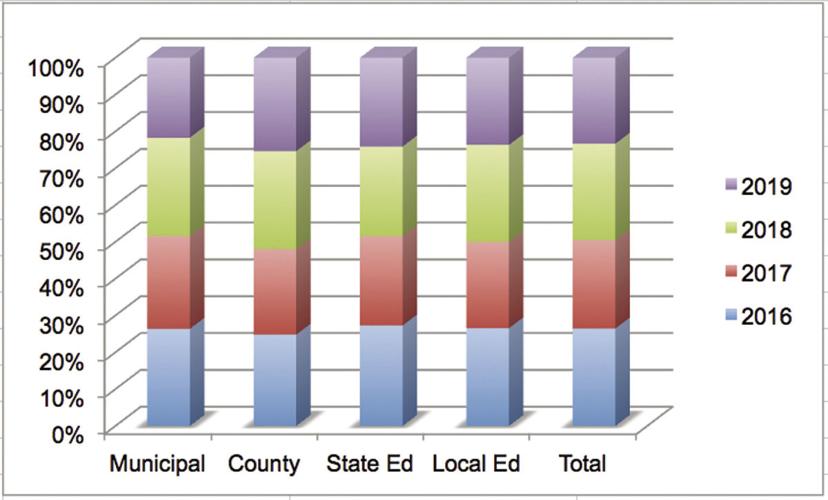

Alton Tax Rate Drops Nearly 11 Percent Local News Laconiadailysun Com

A Tobin tax was originally defined as a tax on all spot conversions of one currency into another.

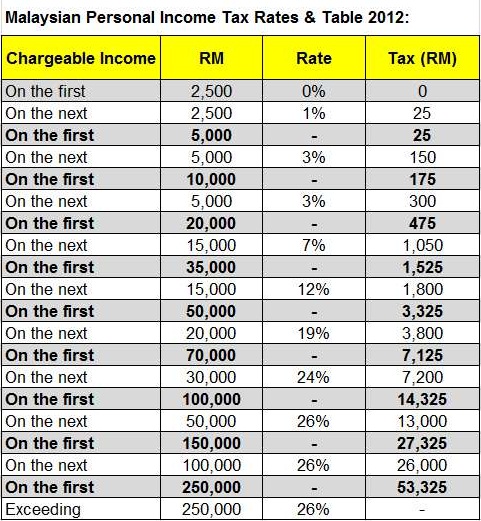

. Interest Rate in the United States averaged 543 percent from 1971 until 2022 reaching an all time high of 20 percent in March of 1980 and a. Details of Public Revenue - Mongolia. Based on the chargeable income tax rate of 0 to 28 is applied.

19 standard rate 9 food medicines books newspapers and hotel services. RANGE OF CHARGEABLE INCOMERM COMPUTATION. Income Tax Slab Rates for FY 2021-22 AY 2022-23 FY 2022-23 AY 2023-24 under old tax regime.

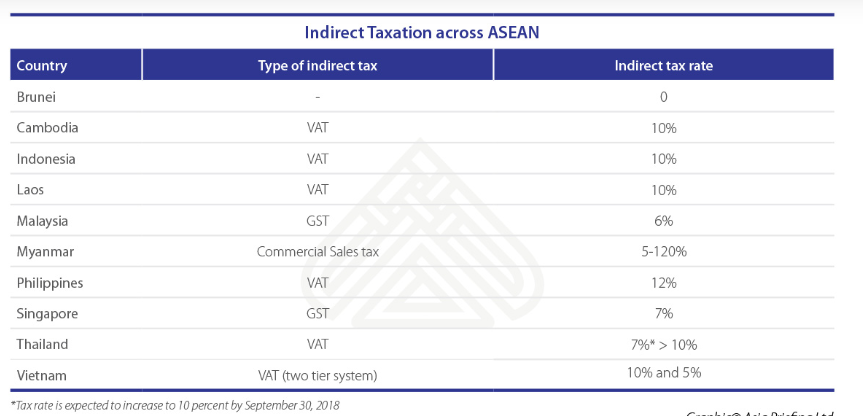

Goods and Services Tax Malaysia. It was suggested by James Tobin an economist who won the Nobel Memorial Prize in Economic SciencesTobins tax was originally intended to penalize short-term financial round-trip excursions into another currency. Sales tax was reinstated on 1 September 2018 as Malaysia moved away from the former GST regime.

This statistic shows the unemployment rate in Malaysia from 1999 to 2021. Government at a Glance. Table IV - Aggregate totals by tax rate of MNE sub-groups.

All price above will subject to Malaysia Service Tax at 6 commencing 1 September 2018. August 2018 2 July 2018 3 June 2018 7 August 2016 1 July 2016. As a general rule goods are subject to sales tax at a rate of 10 however some goods are taxed at the reduced rate of 5 specific rates and others are specifically exempt.

Returns as of 10262022. Malaysia has imposed capital gain tax on share options and share purchase plan received by employee starting year 2007. Headquarters of Inland Revenue Board Of Malaysia.

Check out this article to find out everything about income tax for sole proprietors and partnership in Malaysia now. Malaysia m ə ˈ l eɪ z i ə-ʒ ə mə-LAY-zee-ə -zhə. According to the International Monetary Fund IMF on a per capita income basis India ranked 142nd by GDP nominal and 125th by GDP PPP.

It was 20 prior to that for a full year from 2011 to 2017 which in turn was a result of a progressive raises in the preceding years. Crude Oil Production in Malaysia increased to 513 BBLD1K in June from 484 BBLD1K in May of 2022. Best Tax Saving Plans.

0 Taxable income band MYR. The income tax slab rates specify the threshold yearly limits at which a higher a lower tax rate is applicable. The GST standard rate has been revised to 0 beginning 1 June 2018 pending the total removal of the Goods and Services Tax Act in parliament.

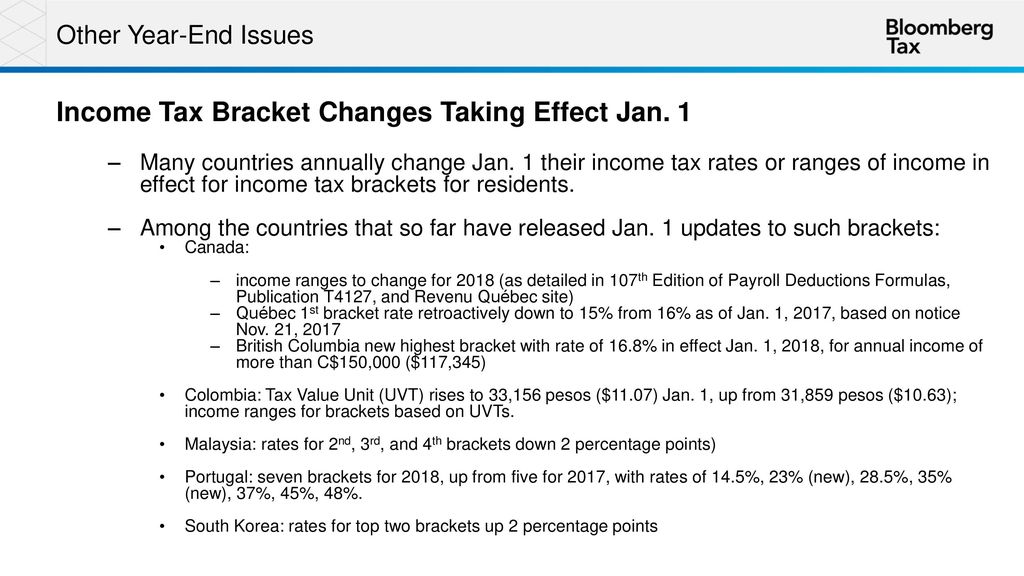

Regulation in Network and Service Sectors 2018. Year Assessment 2017 - 2018. The Fed raised the federal funds rate by 75 bps to the 3-325 range during its September meeting the third straight three-quarter point increase pushing borrowing costs to the highest since 2008.

Calculated by average return of all stock recommendations since inception of the Stock Advisor service in February of 2002. Unlike 10 in Mutual Funds. Prices do not include sales tax.

From independence in 1947 until 1991. The new rate is to be effective from 1 April 2018. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

View all tax guides. Basic Statistic Average monthly unemployment benefit in Romania 2018-2020. 115-97 permanently reduced the 35 CIT rate on resident corporations to a flat 21 rate for tax years beginning after 31 December 2017.

Finance Minister Malusi Gigaba announced on 21 February 2018 that the VAT rate will be increased by one percentage point to 15. Given below are the income tax rates for FY 2021-22 AY 2022-23 and FY 2022-23 under the old tax regime. This page provides - Denmark Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar.

Zero-rated and exempted supplies. The tax rate for. The economy of India is a middle income developing market economy.

This page provides the latest reported value for - Malaysia Crude Oil Production - plus. Crude Oil Production in Malaysia averaged 65459 BBLD1K from 1993 until 2022 reaching an all time high of 791 BBLD1K in October of 2004 and a record low of 461 BBLD1K in October of 2021. An application for the tax exemption can be submitted to Talent Corporation Malaysia Berhad from 1 January 2018 to 31 December 2023.

A chargeable income is obtained. Aggregate totals by tax rate of MNE groups. By May 2018 the new Malaysian government led by Mahathir Mohamad decided to reintroduce the Sales and Services tax after completely scrapping GST.

American Family News formerly One News Now offers news on current events from an evangelical Christian perspective. Inflation rate in Italy 2015-2018 by macro. Is a country in Southeast AsiaThe federal constitutional monarchy consists of thirteen states and three federal territories separated by the South China Sea into two regions Peninsular Malaysia and Borneos East MalaysiaPeninsular Malaysia shares a land and maritime border with Thailand and maritime.

US tax reform legislation enacted on 22 December 2017 PL. Expat Tax Guides Read tax guides for expats provided by EY. Taxable income band MYR.

Product Market Regulation 2018. Prices do not include sales tax. Semua harga di atas akan dikenakan Cukai Perkhidmatan Malaysia pada 6 bermula 1 September 2018.

The tax rate here also is 20. Value-added tax VAT in South Africa was set at a rate of 14 and remained unchanged since 1993. Some basic food stuffs as well as paraffin will remain zero-rated.

From 1 January 2018 the capital gains tax in Iceland is 22. You pay a maximum of 2280 RON as CASS contribution in 2018 if you earn over RON 22800 for the whole year 10 income tax. Highest prevailing marginal state and local sales tax rate 0.

Tax Rate of Company. Details of Public Revenue - Maldives. It is the worlds fifth-largest economy by nominal GDP and the third-largest by purchasing power parity PPP.

115-97 moved the United States from a worldwide system of taxation towards a territorial system of taxation. By the late 1990s the term Tobin tax was being applied to all forms of. Under the old income tax regime a higher tax exemption limit is available to senior citizens and super senior.

This statistic shows the average inflation rate in Malaysia from 1987 to 2021 with projections up to 2027. Get Returns as high as 15 Zero Capital Gains tax. Exempt goods and goods taxable at 5 are defined by the HS tariff code.

Among other things PL. For FY 2017-2018 the tax exemption limit is up to Rs3 lakhs except for those who are covered under. A lawsuit is a proceeding by a party or parties against another in the civil court of law.

Government at a Glance - 2021 edition. The Personal Income Tax Rate in Denmark stands at 56 percent. Our experienced journalists want to glorify God in what we do.

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

India S Government Delights Businesses By Slashing Corporate Tax The Economist

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Paying Property Tax In Malaysia Here S Your 2017 2018 Guide Wise Formerly Transferwise

2017 Year End Issues For Payroll Ppt Download

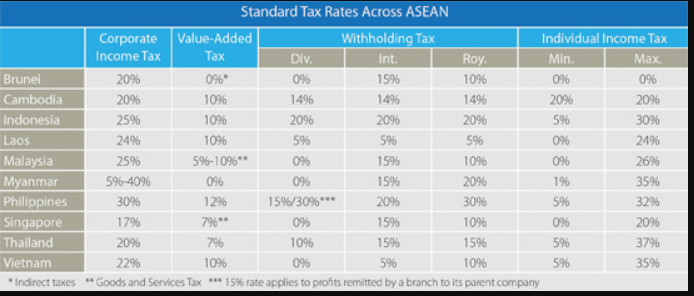

Snapshot Of Asean Tax Rates Htj Tax

Malaysia Inflation Picks Up In May 2018

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

What You Need To Know About Payroll In Malaysia

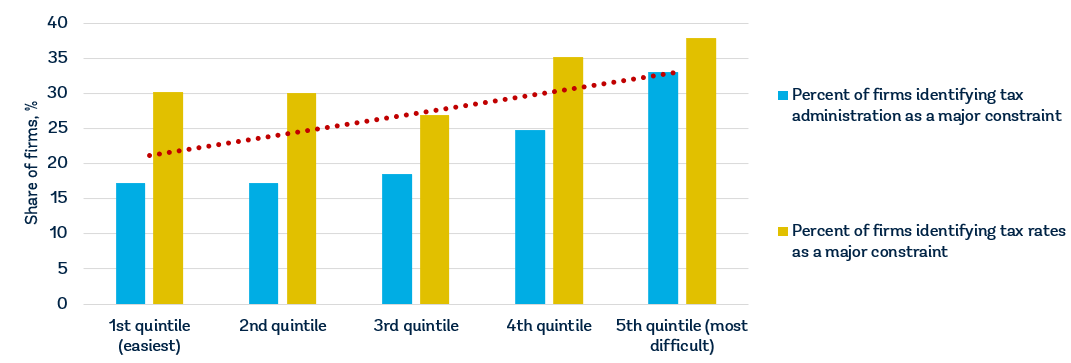

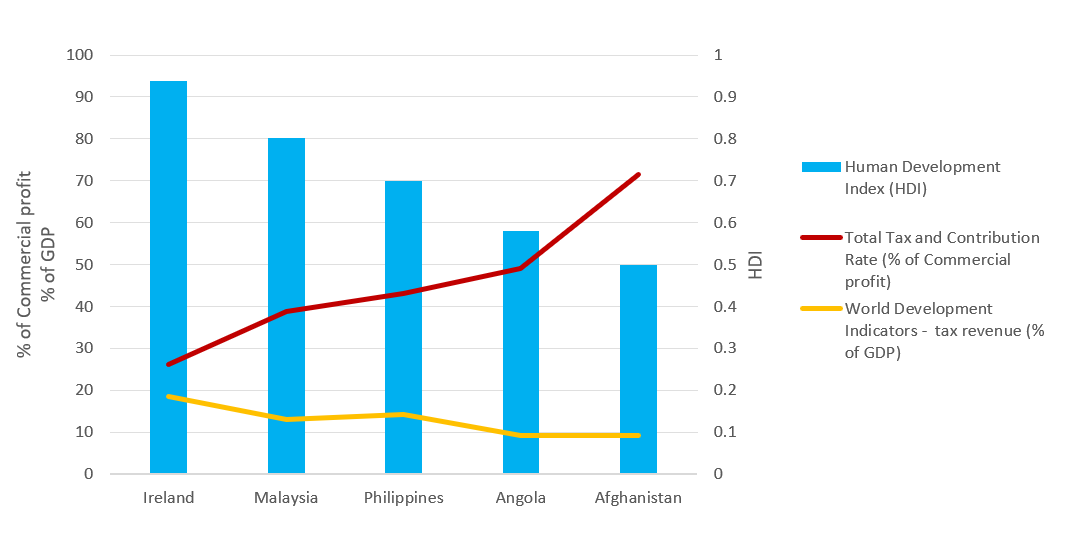

Why It Matters In Paying Taxes Doing Business World Bank Group

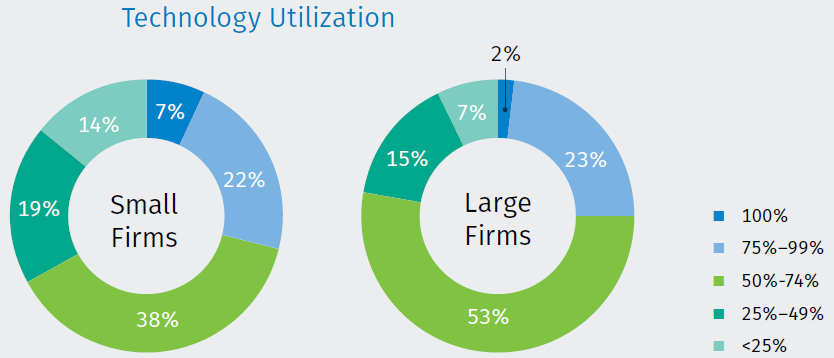

Survey Tech Is The Path To A Better Tax Season Cpa Trendlines

Snapshot Of Asean Tax Rates Htj Tax

Malaysia Total Tax Rate For Medium Sized Businesses 2018 Statista

Malaysia Tax Rate For Company And Income Tax For Foreigners And Local

Malaysia Total Tax Rate For Medium Sized Businesses 2018 Statista

Corporate Tax Rates In Asean As Of 31 St Of December 2018 Download High Resolution Scientific Diagram

Why It Matters In Paying Taxes Doing Business World Bank Group

Comments

Post a Comment